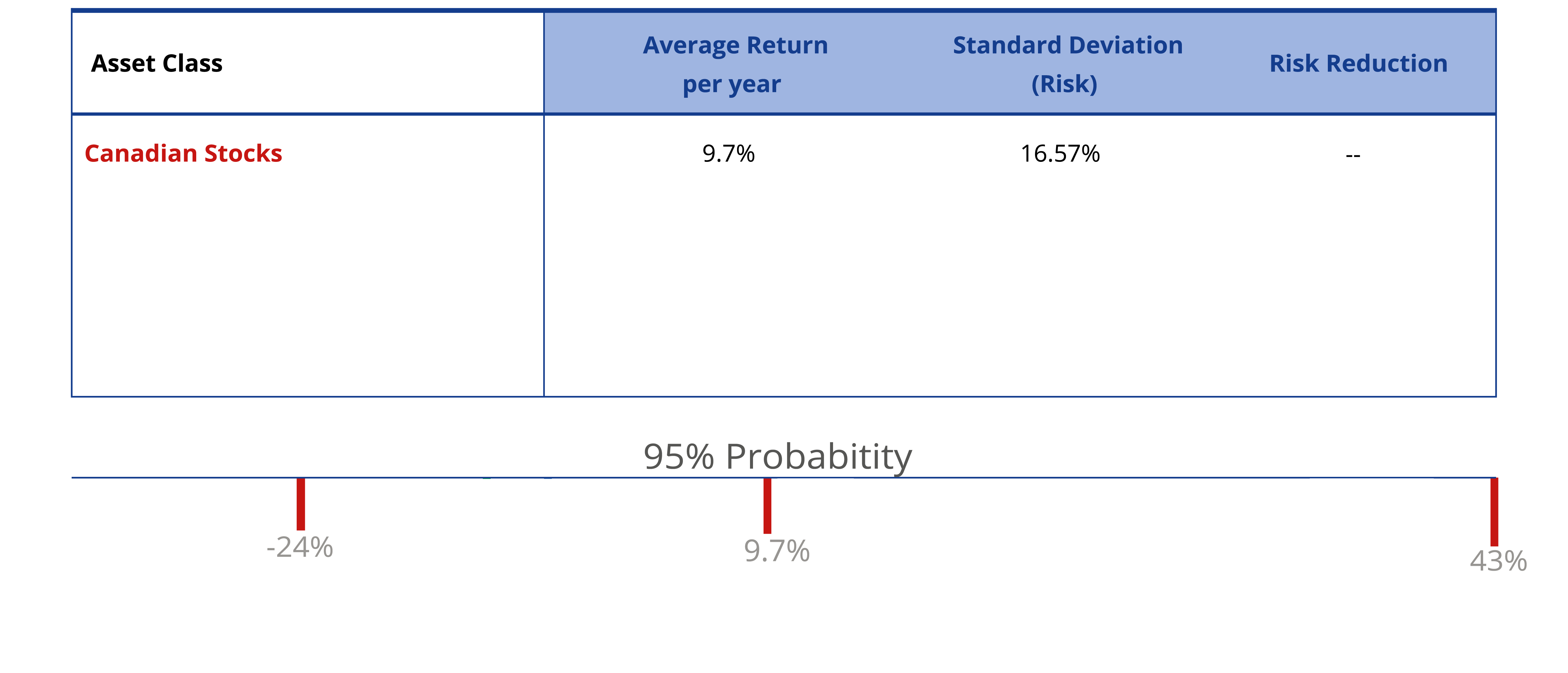

The following illustrations reveal the powerful effect of combining asset classes to reduce risk.

From 1970 to 2009, a Canadian stock portfolio (single asset class) earned an average annual return of 9.70% with a “standard deviation” of 16.57%. Standard deviation is a statistical measure of volatility around an expected return and a lower standard deviation is representative of lower portfolio risk. In other words, over the period of study, Canadian stocks averaged 9.70% per year but, in any given year returns fell between -24% and +43%, 95% of the time.

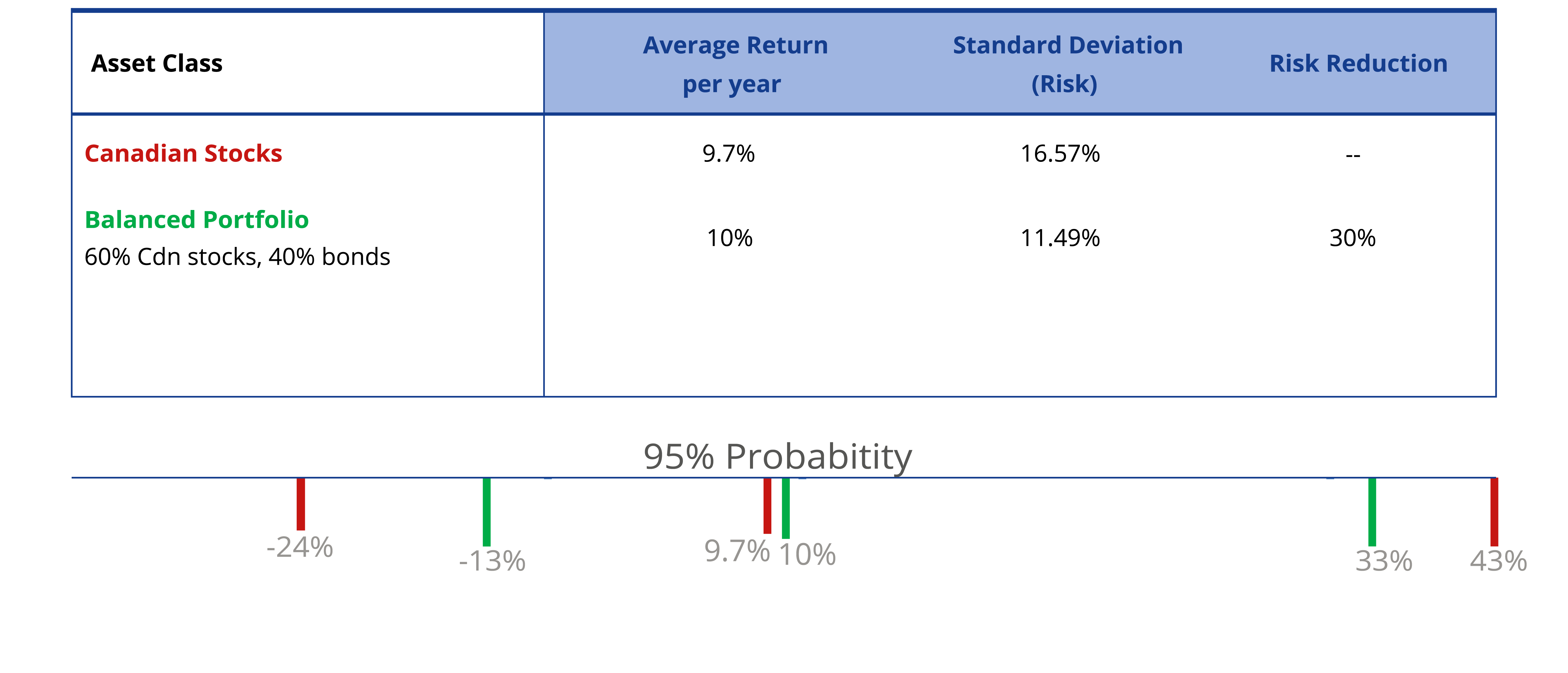

Efficient diversification aims to combine asset classes and reduce portfolio risk such that actual returns each year are less volatile and closer to the expected return.

A balanced portfolio (two asset classes) consisting of 60% Canadian stocks and 40% Canadian bonds provided a substantial reduction in risk compared to a single asset class portfolio. Shifting 40% of the portfolio into bonds reduced portfolio standard deviation from 16.57% to 11.49%. Portfolio risk declined by 30% and yearly returns fell into a tighter range between -13% and +33%.

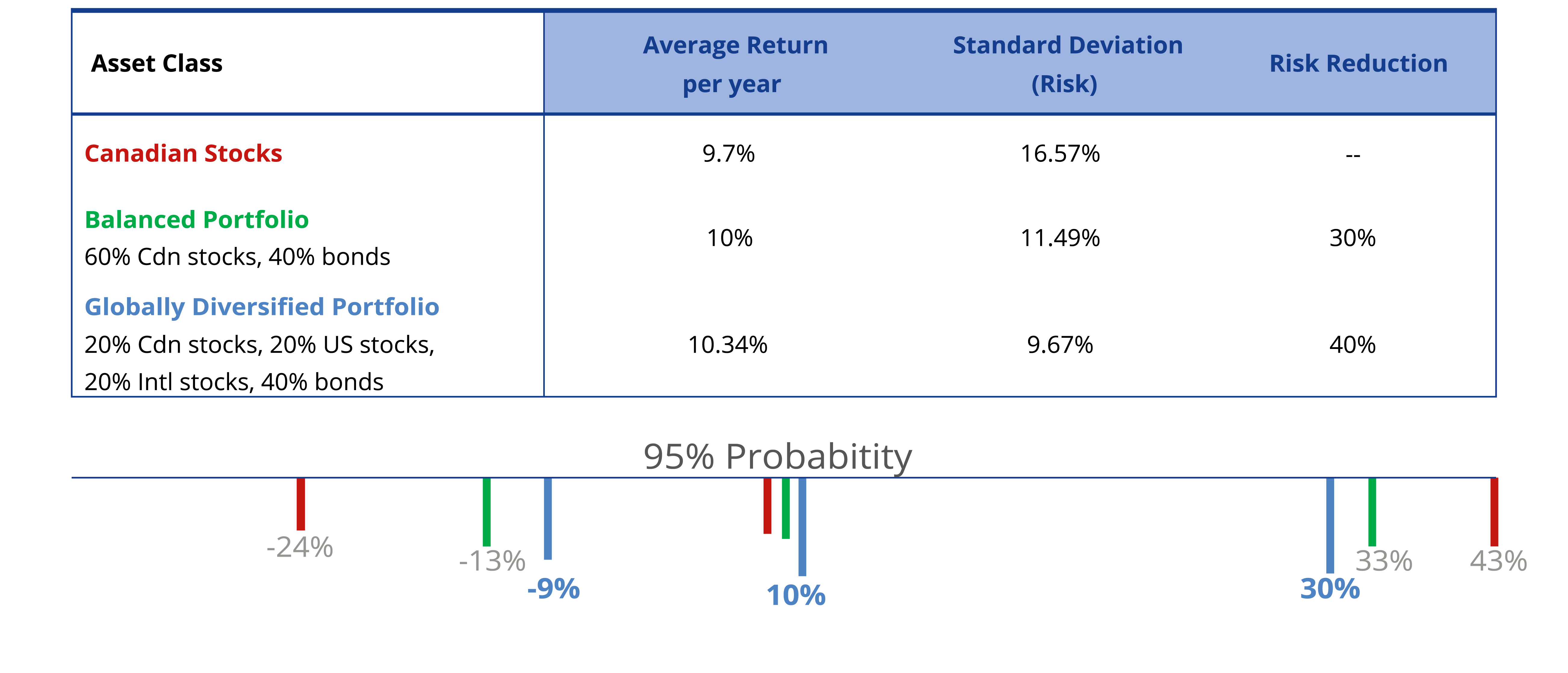

A similar outcome is achieved by adding global diversification to a Canadian stock and bond portfolio. If we include 20% U.S. equity and 20% international equity, the four-asset class portfolio return rises to 10.34% per year while portfolio risk declines to 9.67%.

Adding asset classes such as bonds and foreign investments to a Canadian stock portfolio reduces risk by 40% and narrows the range of returns in a given year to between -9.0% and +30%.

This is how riskier asset classes can improve returns and reduce portfolio risk even though an asset class may be considered volatile on its own.

Combining Asset Classes (1970-2009)

Bond Portfolio from 01/1970 to 12/2009. Rebalance: Per 1 Month. One-Month US Treasury Bills: 75%, DEX Long-Term Bond Index: 25%, Currency: CAD

Balanced Portfolio from 01/1970 to 12/2009. Rebalance: Per 1 Month. S&P/TSX Composite Index: 60%, DEX Long-Term Bond Index: 40%, Currency: CAD

Diversified Portfolio from 01/1970 to 12/2009. Rebalance: Per 1 Month. MSCI EAFE Index (net div.): 20%, S&P 500 Index: 20%, S&P/TSX Composite Index: 20%, DEX

Long-Term Bond Index: 40%, Currency: CAD